Succession Planning & Ownership Transfer: Getting It Right the First Time

Ownership transition is one of the most difficult processes that a privately-held construction company will face in its business life cycle. Family, key employees, competitors, financial investors, and investment firms all play critical roles in its success.

Creating and implementing a formal business transition plan helps to ensure the selling party’s goals and objectives are properly documented and addressed. A solid succession plan should:

While construction company owners have vast knowledge of their respective specialties, most have limited experience in the sales and divestitures of their own business interests. Not only must an owner decide on the proper course of action, but he or she must also be prepared to address and resolve any unanticipated issues. Additionally, the owner must consider the possibility that the transition plan may fall through.

While many construction owners prefer to pass their businesses on to family members or key employees, third-party sales generally lead to the strongest financial gains. Transitioning to family members or key employees, while well-intentioned, might lead to uncovering weaknesses where the company previously exhibited strength. These weaknesses may be attributed to a lack of management, financial, business development, executive leadership, and/or entrepreneurial skills.

While the chances for a successful sale and transition are impacted by a number of factors, there are four mistakes most prevalent during the transition process:

Even if the transition is properly contemplated, planned, and executed, companies will likely still face a variety of challenges. Some important questions to consider during the transition process include:

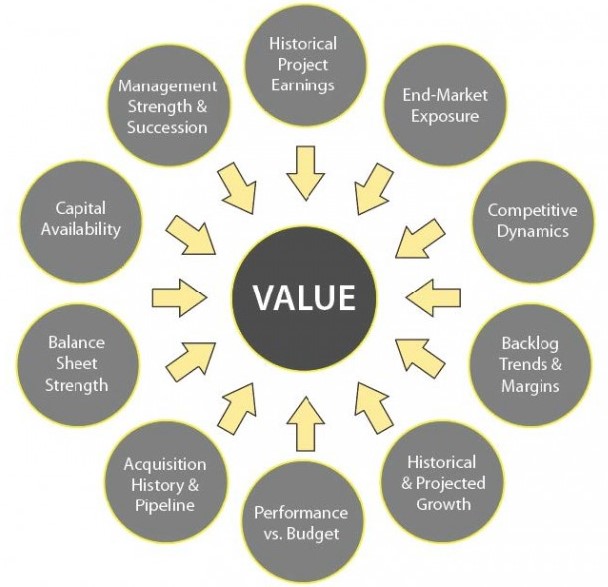

Key factors that impact the value of the construction company can generally be categorized into four main areas:

The value of a construction company can be maximized if it has core fundamental strengths. A high-value contractor has a healthy balance sheet, strong working capital, minimal line of credit borrowings, positive bank and bonding company relationships, and minimal historical and prospective exposure to sever job losses and contract litigation. Another core attribute that tends to increase value is the contractor’s ability to maintain a strong quality of backlog projects that will yield quality gross profit margins with minimal booking risk and profit erosion, along with experienced project field and oversight personnel.

Ultimately, the value of a construction company is determined by proper negotiation between the buying and selling parties. For contractors, value may be a combination of equipment value, real estate value, customer list value, intangibles value, and, most importantly, value associated with company earnings. With various methods available to determine the value of a construction company, here are three primary approaches:

1.) The asset-based approach separately values the assets of the company to determine its value as a whole. Asset-based is an important approach for contractors that own significant equipment and real estate assets.

2.) The market-based approach uses comparable transactions, multiples, and other financial data from other comparable transactions and applies the results to the selling company.

3.) The income-based approach multiplies a company’s earnings or some form of earnings, such as earnings before interest, taxes, depreciation, and amortization (EBITDA), by an agreed-upon value. Construction company valuations use this approach based on “re-casted” or “normalized” EBITDA, which takes into account certain owner-related transactions and unusually positive or negative job performance results.

When determining value associated with a construction company’s earnings, the income statement must be carefully reviewed to ensure that all appropriate adjustments are made. These adjustments may include one-time significant construction gains and losses, excessive or insufficient compensation paid to key employees, family perquisites, non-market leasing arrangements with related parties, and legal matters resolved in a given operating cycle.

Now, let’s review the most prevalent business transition methods in construction.

Under a new ownership structure and management team, the company secures funding from a bank in order to buy out the current owners, or the existing owners provide self-financing of the transaction. The bank or selling note holder would be paid off over the term of the note using future cash flows. Generally, a bank note would require significant collateral and personal guarantees from the new owners and perhaps even the selling party.

Here are four steps to a successful internal sale:

A third-party sale is typically the best opportunity for the company’s shareholders to maximize value and liquidity while minimizing deal risk. However, the external sale creates the most exposure to future change in operations, employees, and, most importantly, company culture.Generally, a third-party sale provides the highest level of arm’s length value for the selling party, the greatest cash payment at settlement, and the optimum ability to go to closing by both parties. However, an external sale will most likely have fairly significant non-compete and employment agreements, which will severely limit the exiting shareholder’s ability to continue within the industry in the near term.

A recapitalization occurs when the current owners identify a financial partner willing to acquire a majority of the stake in the company. The financial partner typically invests heavily in the company and ultimately seeks a premium with a three- to five-year exit window. Traditionally, a financial partner may be a private equity firm, mezzanine firm, or financing firm that may have developed a particular niche in the construction industry. It is possible that a recapitalization could be part of a more significant roll-up of common companies in a particular niche area (e.g., mechanical or electrical contractors in a particular region). While there is exposure in a recapitalization transaction, there may be a considerable benefit if the future or second level exiting transaction is successful.

An Employee Stock Ownership Plan (ESOP) trust is formed in order to acquire stock from the selling owners in exchange for liquidity. Shares are then allocated over time to the accounts of eligible employees based on various factors. The ESOP offers the opportunity to create significant tax savings to the selling shareholders as well as to the company, if the company makes an S corporation election. Key considerations when forming an ESOP include:

While the old company ceases to build up value along with its operations, the new company finishes the work left behind by the old company under a project completion agreement. Meanwhile, as the new company establishes its financial strength, the old company guarantees the bank debt and bonding line of the new company for a period of time. The benefits of this transition method include financial and surety support, technical construction support, and corporate culture continuity. The concept of forming a new company provides a method to transfer an existing company to a single person or a management group that may be able to bypass many of the difficulties of an outright sale. Under this transition method, the existing business remains under the original owner’s ownership and control, and a new company is formed to manage new work to the business. All of the old company’s work is also subcontracted to the new company to complete under a subcontracting completion agreement. All of the new company’s work will be contracted under the new entity and thus, the new company is established. After a period of time, the old company will be dissolved, and only the new company will remain.

If there is one industry that understands the need for planning, it is construction. Timelines, deadlines, and changing conditions are factors that construction leaders handle on a daily basis. The companies that are strategic, methodical, realistic, and committed to a successful transition will be best positioned for positive results.

When a contractor is seeking an exit plan, it is imperative to consult with a team of professional advisors including financial, tax, and legal experts highly experienced in construction financial management. If a contractor is considering a third-party sale, then it is also vital to identify an investment banking firm or financial advisor firm that specializes in construction. By planning early and focusing on setting the company up for sale in the future, there is a greater likelihood of a successful transaction. The best time to sell a construction company is when the construction market and backlog of jobs is strong, with healthy profit margins. And remember, the people are the key to value, so it is essential to ensure the employees who are critical to business development, estimating, operations, and field support continue to run a successful construction company.

Get ready, because by subscribing to our email insights, you'll be among the first to hear from our experts about key issues directly impacting your privately held business or not-for-profit.