Give Smarter, Not Harder: Making the Most of Qualified Charitable Distributions in 2025

This article was also featured as sponsored content on the Baltimore Business Journal’s website.

With new tax laws, come fresh opportunities—and plenty of head scratching. On July 4th, 2025, the U.S. unwrapped its latest tax legislation: the One Big Beautiful Bill Act (OBBBA). The OBBBA brings a lot to the table and a lot of it is confusing, but one area that deserves some special attention is also one of the most overlooked tools in individual tax planning: the Qualified Charitable Distribution, or QCD.

A QCD is a direct transfer of funds from your IRA to a qualified charity. If you’re 70½ or older, you can make a QCD of up to $108,000 per year—and starting in 2025, that figure is indexed for inflation in future years.

What’s the real magic of a QCD? It counts toward your Required Minimum Distribution (RMD) but doesn’t count as taxable income. That means it lowers your adjusted gross income (AGI), and when AGI goes down, your chances of qualifying for other deductions and credits goes up.

In short, you can support your favorite nonprofit and shrink your tax bill.

One of the big-ticket changes in OBBBA is the increase of the state and local tax (SALT) deduction cap from $10,000 to $40,000 for joint filers. Sounds great, right? Not so fast, because there’s a catch: If your modified AGI is above $500,000, that generous SALT deduction starts to fade. It’s phased down by 30% of the amount over that $500,000 threshold, with a hard floor of $10,000.

But a QCD can keep your AGI under that $500,000 limit, preserving the full $40,000 SALT deduction. And when you layer in mortgage interest and charitable giving, the result can be a real difference in taxable income.

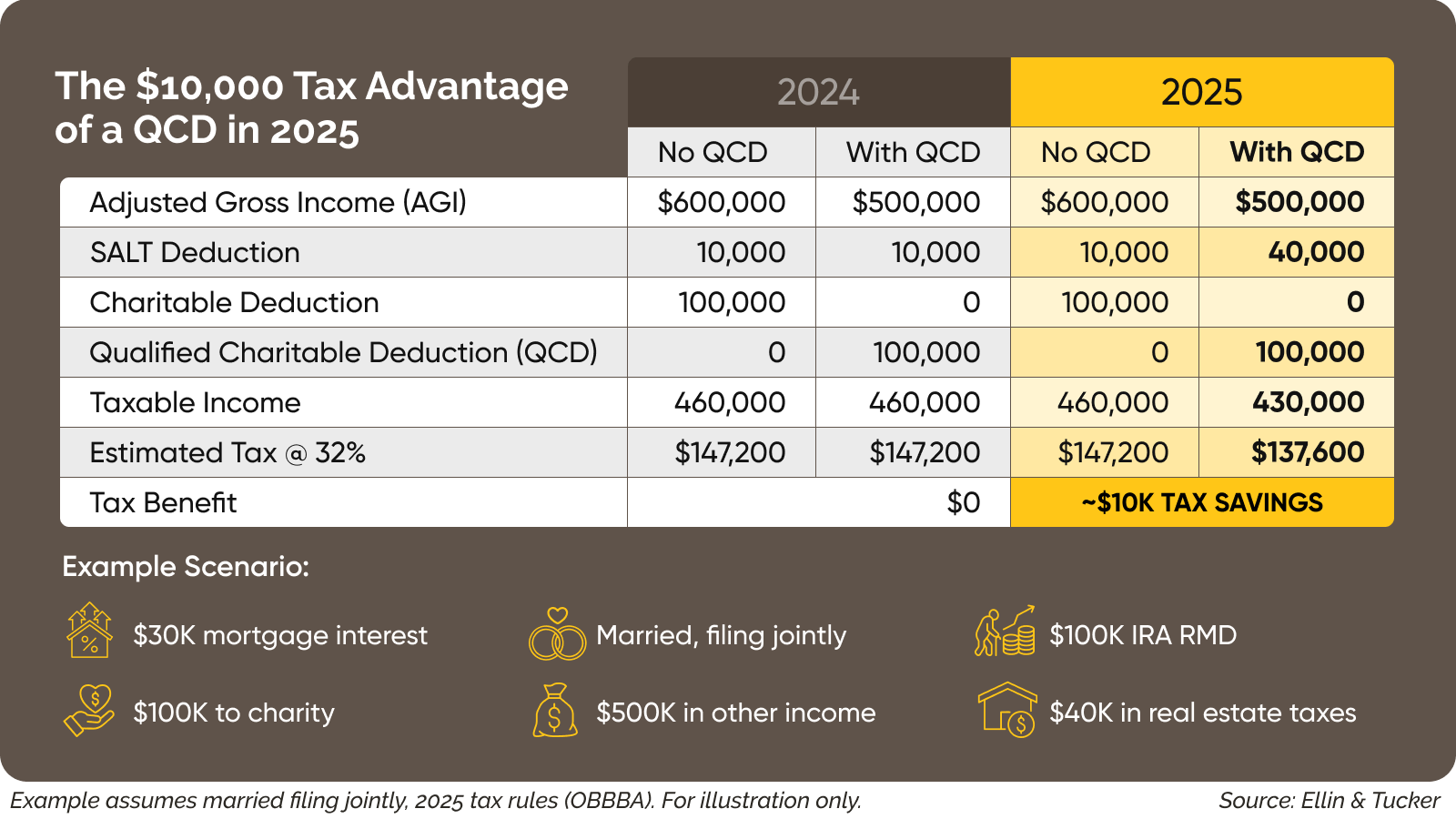

Let’s look at an example represented visually below, to illustrate how this works in the real world. Suppose a married couple filing jointly has $500,000 in other income, along with a $100,000 IRA RMD, $40,000 in real estate taxes, $30,000 in mortgage interest, and $100,000 to charity. By giving the same $100,000 to charity through a QCD, they save $10,000 in taxes in 2025.

For Maryland taxpayers, keeping an eye on AGI is about more than just the IRS—it’s about protecting deductions at the state level, too. Proactive planning now can help you head into 2025 with a strategy that keeps more money in your pocket. A lower AGI can:

The OBBBA has already introduced sweeping tax changes, but more are on the horizon. Starting in 2026, higher earners will face additional limits on itemized deductions—making proactive planning before the end of 2025 more important than ever. Here’s what’s coming:

Tax law is never simple, but proper planning and proactive action can make things much easier. QCDs offer a smart, straightforward way to reduce your AGI, potentially increase your deductions, and give back in a big way. If you have questions about how a QCD or DAF could fit into your 2025 tax plan, we’re here to help! At Ellin & Tucker we support individuals and families to make the most of their charitable impact, while navigating the shifting sands of the tax code.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.