Accounting Standard Update: Gifts-in-Kind

Gifts-in-kind, also known as nonfinancial assets or in-kind donations, are a type of charitable giving where goods and services are given as a “gift” to an organization in place of cash contributions. In most cases, gifts-in-kind come in the form of free specialized labor such as legal or accounting services, use of space for free or at a discounted rate, baskets of goods for an auction, tickets for sporting events, food, clothing, etc. Gifts of cash or stock are not considered gifts-in-kind.

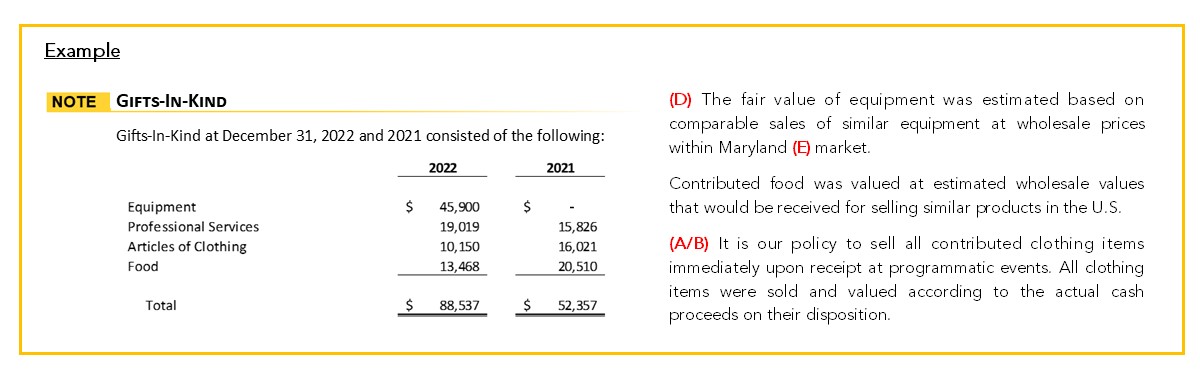

Gifts-in-kind used by an organization for their intended purposes are considered utilized, while donations that are sold for a profit are considered monetized. This is frequently seen in a charity auction setting.

Currently, organizations are expected to describe programs for which gifts-in-kind were received and used and recognize amount as revenues, while also disclosing the fair value of services received that weren’t recognized as revenue. Accounting Standard Update (ASU) 2020-07 builds on these current requirements and improves financial statement comparability.

ASU 2020-07, issued by the Financial Accounting Standards Board (FASB), will go into effect January 1, 2022 and affect fiscal years beginning after June 15, 2021. Implementation may also affect earlier periods, as the disclosures are retrospective and will require comparative information from 2021. The update can also be adopted early and requires the following:

A: Developing a gift acceptance policy is not only a great way to avoid filling your office with items your organization doesn’t need, but also helps donors make the best in-kind donations to support your mission. This document can vary in length and detail depending on the organization, but it should include:

A: The organization should send the donor an acknowledgement letter that includes your tax ID number, a description of the goods and services the donor provided, and the date you received them. The acknowledgement letter should include a statement that the donor did not receive substantial goods or services in exchange for the contribution. Donors are responsible for assigning a valuation, so the organization should not include the value of the contribution in the acknowledgement.

A: In-kind donations of property are reported on Form 990 as contribution income. The property value donated should be reported in Part VIII, line 1g of Form 990 as well as line 1 of Part II and III of Schedule A, Public Charity Status and Public Support. Additionally, the filing of Schedule B (Schedule of Contributions) and Schedule M (Noncash Contributions) may be required if reporting thresholds are met. Please refer to the schedule instructions for details. In-kind donations of services and the uses of facilities are not included in income on Form 990 and would appear as a reconciling item on Schedule D (Supplemental Financial Statements), if required.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.