Building a Constructive Future with the New Tax Law

Construction business owners experienced significant changes this year as they filed their returns for the first time under the Tax Cuts and Jobs Act (TCJA). Although many filers spent 2018 reacting to the new law (and adjusting), 2019 should be the year to focus on future strategies and understand how to proactively position their construction firm for success under the new tax regime.

New Opportunity for “Small” Businesses

Perhaps the most notable change in the tax law for construction firms was the change in the definition of a small business. Previously, the IRS considered a small business to be one that had average annual gross receipts (AAGR) of $10M or less over the previous three years. But with the passing of TCJA, the three-year average has increased to $25M in annual gross receipts (adjusted for inflation going forward, $26M for tax years beginning in 2019). The change provides many businesses, most notably in the construction industry, with the option to use taxpayer-friendly accounting methods, including the Completed Contract Method. The completed-contract method of accounting is a much simpler method of recognizing revenue: no revenue is recognized until the job is basically finished. Previously, construction businesses with AAGR above $10M had to use the more complex Percentage of Completion Method of accounting for long-term contracts. Although this is ultimately a tax deferral, it provides a great opportunity for tax and cash flow planning, i.e. knowing that a long-term contract started mid-year will not generate any current-year tax revenue. Construction companies that have not been under the $10M threshold for a long period should consult their accountant regarding their accounting for exempt contracts (less than two years to complete).

Bonus Depreciation

Bonus depreciation has existed since 2002 and since its inception, has been a popular method of deferring income tax. Prior to the passing of TCJA, bonus depreciation allowed for expensing 50% of the cost of an asset in the year of acquisition. With the passing of TCJA, business owners are now able to expense 100% of the cost of the asset in the year of acquisition. Some may recall that 100% expensing has always been available through Section 179 depreciation, but Section 179 has always had some caveats and limitations. Most notably, a taxpayer can only take up to $1,020,000 in Section 179 in 2019 and cannot create a taxable loss through Section 179. With bonus depreciation, no matter the situation, whether they’ve acquired $5M in equipment or find themselves in a loss position, they can still expense 100% of the assets’ cost in the first year. This is a great benefit for all taxpayers, but especially for construction firms and business owners who have multiple operating companies. Construction firms are notorious for their capital-intensive nature and are likely to continue purchasing and financing expensive pieces of equipment. An additional cash flow benefit with bonus depreciation is that construction firms can benefit immediately from the tax deduction but pay for the equipment over the term of the financed period.

Optimizing the Pass-through Deduction via Reasonable Compensation and Estimated Tax Payments

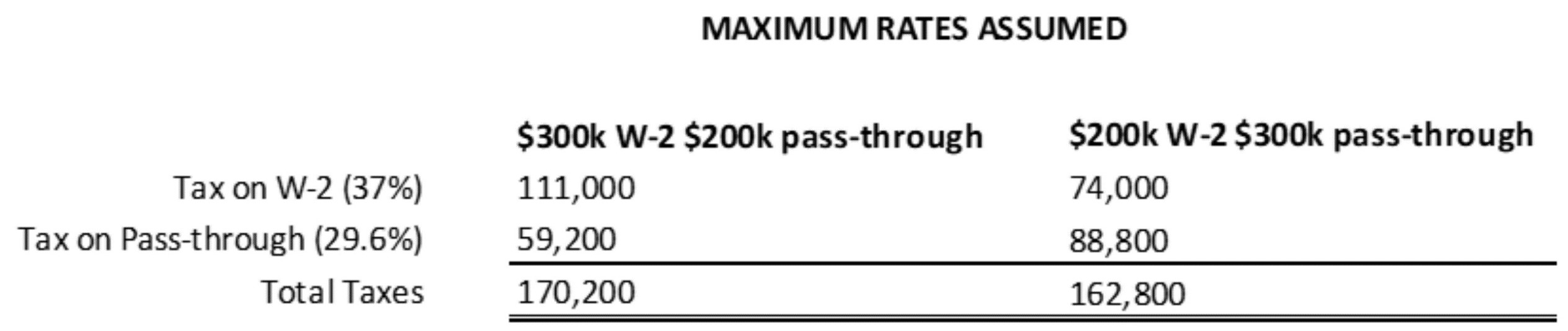

While there is still much to be learned about the nuances of the new 20% deduction for pass-through businesses, it is clear that there are many ways to take advantage. One of the simplest ways is through reasonable owner compensation. But what is considered “reasonable compensation”? Honestly, whatever the business owner’s current base salary happens to be could be considered reasonable compensation. But what about compensation beyond the base salary? For example, in the past, some business owners would pay themselves a year-end bonus and over-withhold their federal and state tax to cover their tax liability. But this is no longer an advisable strategy. Consider the following example. A single shareholder of an S-Corporation receives a $200,000 salary and about $300,000 of pass-through construction income. Traditionally, they do not make estimated tax payments and instead take a $100,000 withholding bonus at year-end, shifting owner compensation to $300,000 and pass-through construction income to $200,000. In the past, this made up for not making the estimated tax payments throughout the year, without any negative effects. But now, they have just converted qualified business income that is taxed at a maximum rate of 29.6% (80% of the top rate) into W-2 wages, taxed at a maximum rate of 37%. What sort of effect can this have on an owner’s taxes?

Even though the income is the same for the owner, they pay about $7,400 less in taxes by simply not taking a year-end withholding bonus. As an alternative to the withholding bonus, pass-through owners should consider taking a distribution each quarter to make estimated tax payments on their business profits. Working with a qualified accountant to determine how much should be paid each quarter is a critical first step.

The TCJA is still a piece of legislation in flux, with many definite questions still-to-be answered until a court has weighed in on the exact interpretation of the law. Until then, counting on the knowledge of an accounting professional is the best way to keep business flowing and money where it can have the most impact on the industry and economy- with the business owner.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.