Charitable Contributions and the New Tax Law: Doing the Right Thing

Many individuals make charitable donations and receive both a charitable deduction and a sense of public goodwill for doing their part. Charitable contributions have also served as a surefire way to reduce tax liability, but due to changes brought on by the Tax Cuts and Jobs Act (TCJA), that may no longer be the case for some donors. Whether due to the general uncertainty surrounding how the TCJA will impact personal spending and net worth, or a decision has been made to reduce charitable contributions because the tax benefit “is not what it once was”, Not-For-Profit organizations seem to have been feeling the pinch. As tax professionals, we are hopeful charitable giving will increase in future years’ as donors have better information on how to have the greatest impact. Here are some ways to feel good about your personal tax situation while supporting the causes close to your heart.

In light of the change in tax law, donors need to understand the new tax landscape when making their charitable contributions. TCJA increased the standard deduction to $24,000 (MFJ) and put a $10,000 cap on state income and property taxes. Outside of state income taxes, the two most common itemized deductions remaining are charitable contributions and the mortgage interest deduction. If a donor has paid off a mortgage, they would need to donate in excess of $14,000 annually to utilize itemized deductions. But this is still not a tax-effective use of charitable dollars. A slight change in the timing of donations could provide significantly more tax benefits without changing the benefit to the organizations and causes they support.

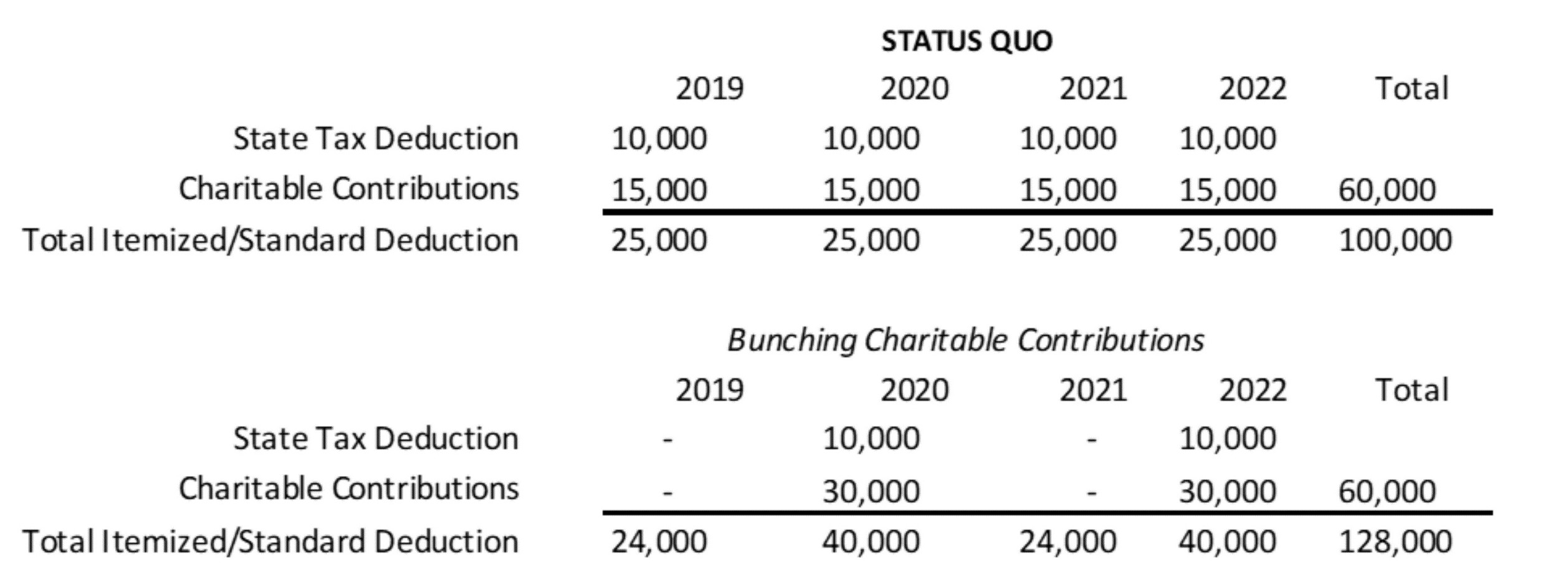

Consider a married couple that does not have a mortgage and donates $15,000 per year to charity. With a maxed-out state tax deduction, their itemized deductions would be $25,000, only $1,000 over the standard deduction. What if that same couple donates the money they have allotted for their 2019 and 2020 charitable giving in January 2020 and December 2020? How would that affect their taxes?

This is called a “bunching strategy” and provides the taxpayer with an additional $28,000 in deductions over four years, with no change in total charitable giving. Additionally, if the taxpayer makes their donations in January and December of a giving year, there should be minimal change in cash flow for the taxpayer and the charitable organization, a win-win for everyone involved.

If a taxpayer has not determined which charitable organizations they wish to give to in upcoming years, there is still a way to take advantage of the bunching strategy. A donor-advised fund (DAF) creates the opportunity to take an immediate tax benefit while determining the qualified charities who will receive the distributions at a later date. There is no time limitation as to when a DAF’s assets must be distributed. An additional DAF incentive is the fact that the DAF’s earnings can grow tax-free. A donor and their investment advisors have the capability to manage both the accumulation of income and distributions of assets to charitable organizations of their choosing.

The TCJA is still a piece of legislation in flux, with many questions still-to-be answered until a court has weighed in on the exact interpretation of the law. Until then, counting on the knowledge of accounting and tax professionals is the best way to “do the right thing” and continue to support charitable causes in a tax-efficient way.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.