Check, Please: Deductions for Business Meals and Entertainment Expenses Have Changed

If you think that recent sandwich-spread for your internal business meeting or meal with your business partners at the restaurant was eligible for a 100% tax deduction, you’d better think again.

As of January 1, 2023, the deduction of a business-related meal will revert to the standard 50% limitation as outlined in the Tax Cuts and Jobs Act of 2017.

Previously, under the Consolidated Appropriations Act of 2020, taxpayers have been able to deduct 100% of the cost of meals in 2021 and 2022, as long as they were purchased from a restaurant with a business purpose. This legislation was meant to reward businesses for supporting the struggling restaurant industry, hurt by the pandemic.

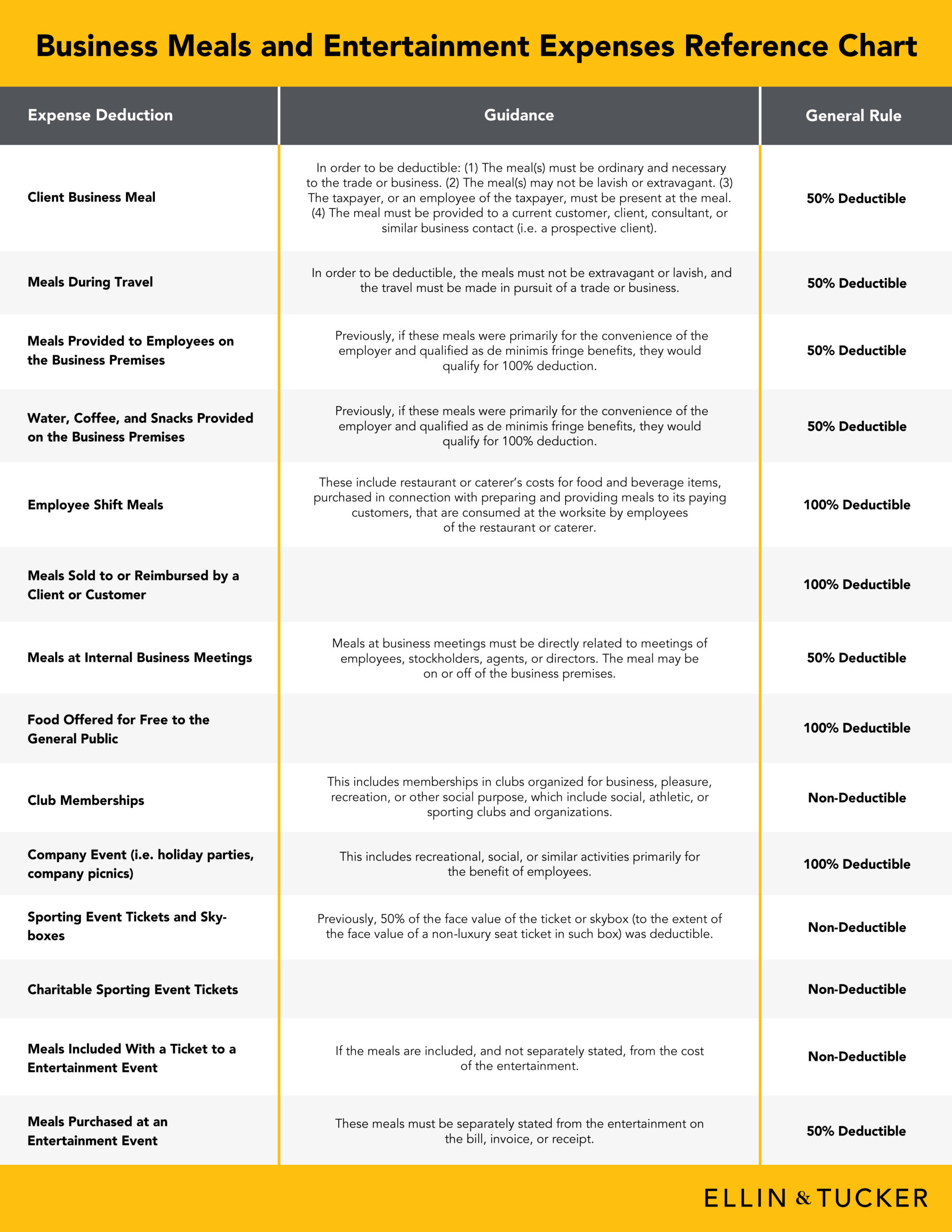

Below is a reference chart showing the types of business meal and entertainment expenses, and the deductibility you can expect moving forward.

Click here to download a PDF of the Business Meals and Entertainment Expenses Reference Chart.

Navigating these changes can always be challenging, and every situation is unique. The tax experts at Ellin & Tucker are always prepared to help you get a better understanding of how these changes impact you and your business.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.