Let’s Get Planning: Tax Inflation Adjustments for 2024 are here!

It’s that time of year again, when the Internal Revenue Service (IRS) announces its inflation adjustments on more than 60 tax provisions for the upcoming calendar year. The increase, while significantly less than last year, is a move in the right direction, and could potentially protect more of your income in 2024.

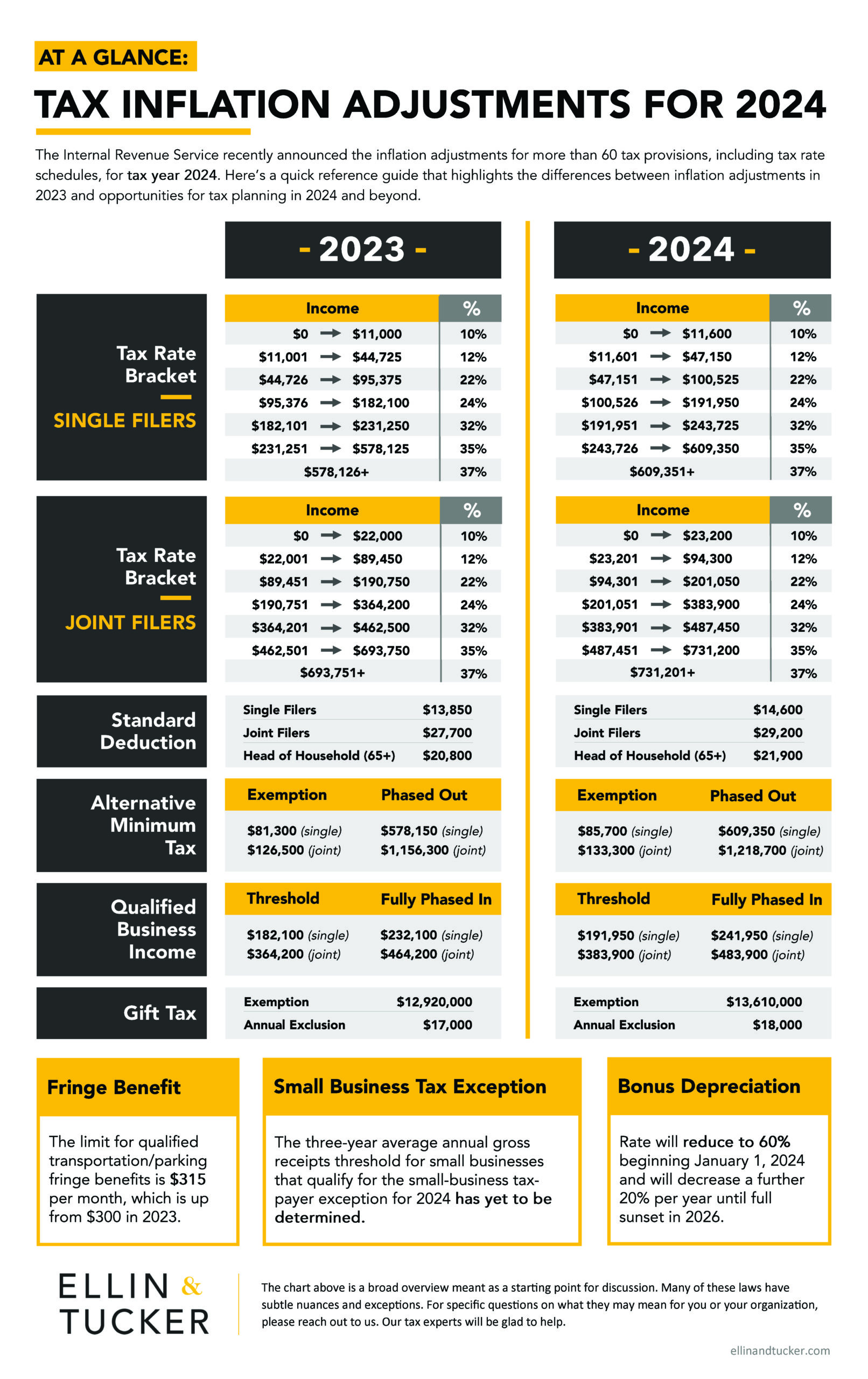

Below is a Tax Adjustment Guide, which provides a side-by-side comparison of the tax brackets and rate schedules for calendar years 2023 and 2024. If you aren’t expecting any significant changes next year, these numbers are here to help you estimate your liability. If you’re expecting a change in your income, getting married, or starting a business, this guide maybe help you identify opportunities for tax planning and other financial savings.

And remember, these new rates are not the rates tied to the income taxes you’ll pay this upcoming filing season. These inflation adjustments are for tax year 2024, which taxpayers will file in early 2025.

You can also download a PDF version of the Tax Adjustment Guide here.

Planning for success is only possible with the right financial advisor at the table. Talk to your accounting team to learn what other tax provisions are changing in 2024. Start the year off on sound financial footing!

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.