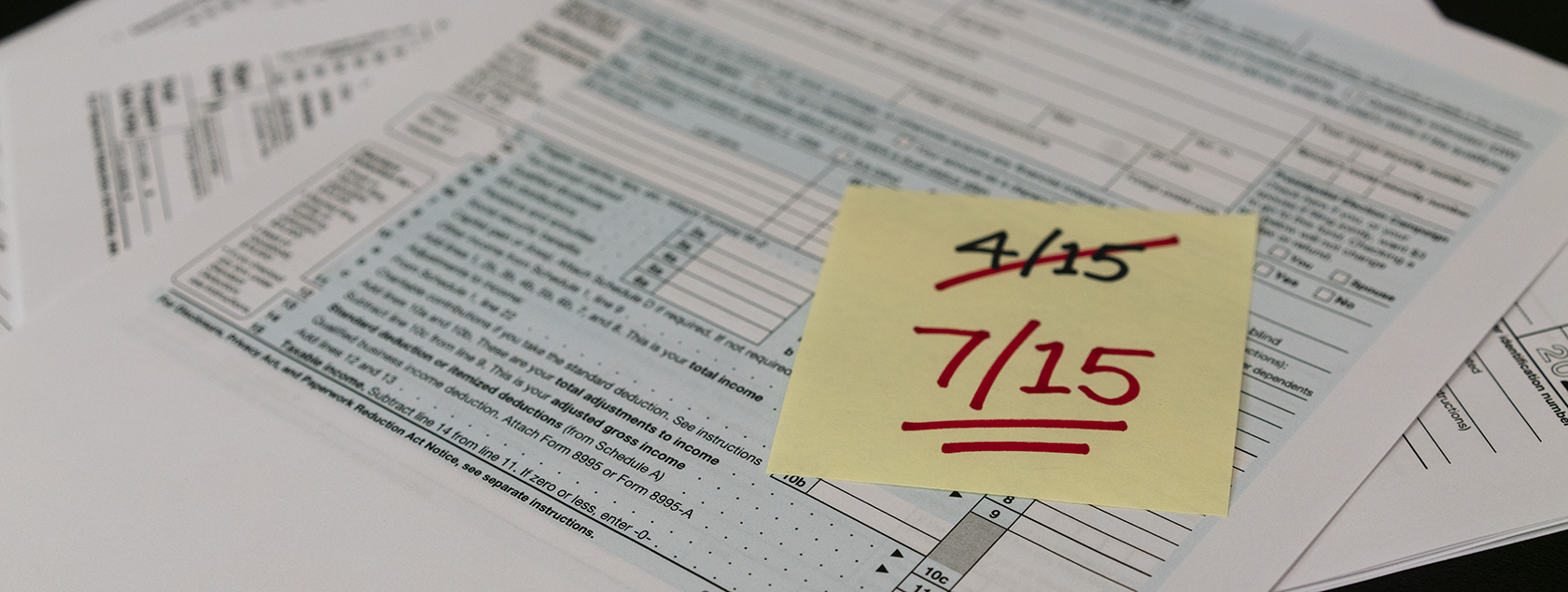

Maryland Announces State Income Tax Filing and Payment Extensions

In a Maryland Tax Alert issued on March 11, 2021, the Comptroller’s office has decided to postpone certain state tax filing and payment deadlines to July 15, 2021. The Comptroller’s office stated the reason for the postponement was due to various legislative changes made to Maryland income tax laws during 2021. Additionally, federal legislation under the new American Rescue Plan Act also weighed in on their decision to postpone the deadlines. Below is a summary of what we know so far:

It’s important to note that the U.S. Treasury Department has not made any announcements regarding any federal postponements as of the March 11, 2021.

Do not hesitate to contact a member of our tax team with any questions you may have regarding this extension and how it may affect you. We will continue to update this article with any new information as it becomes available.

Get ready, because by subscribing to our email insights, you'll be among the first to hear from our experts about key issues directly impacting your privately held business or not-for-profit.