Maryland Will Not Assert State Income Tax Nexus for Teleworking

COVID-19 has dramatically impacted our lives in many ways, and work location is no exception. Employers adapted their business practices to accommodate remote work in order to protect their employees while still maintaining operations. In many cases these moves were also mandated by state and local laws requiring employers to promote remote work to the fullest extent possible. What many employers do not realize is that in normal circumstances their remote employees could create additional tax filing obligations at the state level, referred to as state income tax nexus.

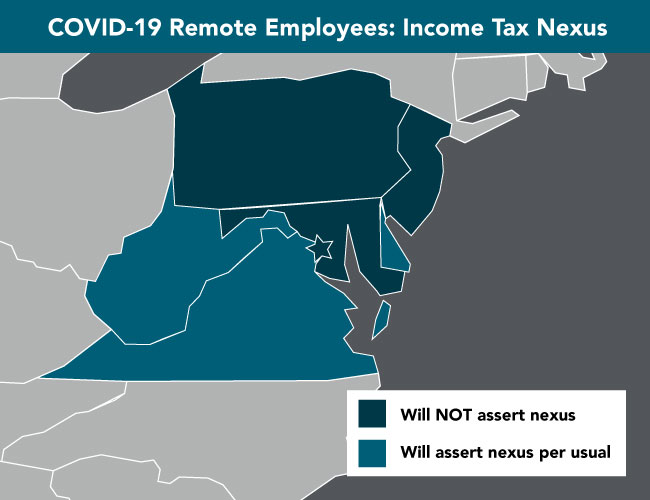

In the Mid-Atlantic region, many employees live and work across state lines. The sudden move to remote work meant that an employee who generally works in an office in Pennsylvania might be living and working remotely in Maryland for the foreseeable future. Before COVID-19, his or her employer would be required to file a Maryland income tax return due to the physical presence of an employee in the state of Maryland. However, Maryland is one of a handful of states that has announced they will not assert nexus based on a remote employee during the COVID-19 emergency.

The guidance for each state is unique and will require monitoring as the situation changes. All states specifically mention that the motivating factor in remote work must be the COVID-19 emergency in order to avoid nexus. As states lift the state of emergency and allow the economy to open up again, if remote work arrangements are continued due to convenience or employee preference, employers must be aware of potential nexus pitfalls. Most state budgets have been gutted by COVID-19 and will be looking to replenish their tax base at the first opportunity. We will continue to monitor the states in the Mid-Atlantic region and beyond as we move from temporary remote work to more permanent telecommuting arrangements.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.