New Legislation Bring Employee Retention Credit Updates

Update: The Infrastructure Investment and Jobs Act, signed into law by President Biden on November 15, 2021, ended the Employee Retention Credit (ERC) 90-days earlier than outlined in the American Rescue Plan Act (March 2021). This means wages paid after September 30, 2021 are no longer eligible for the tax credit as they were before. The only business qualifying for the ERC using wages from October 1, 2021 through December 31, 2021 would be a ‘recovery startup business’ that began after February 15, 2020.

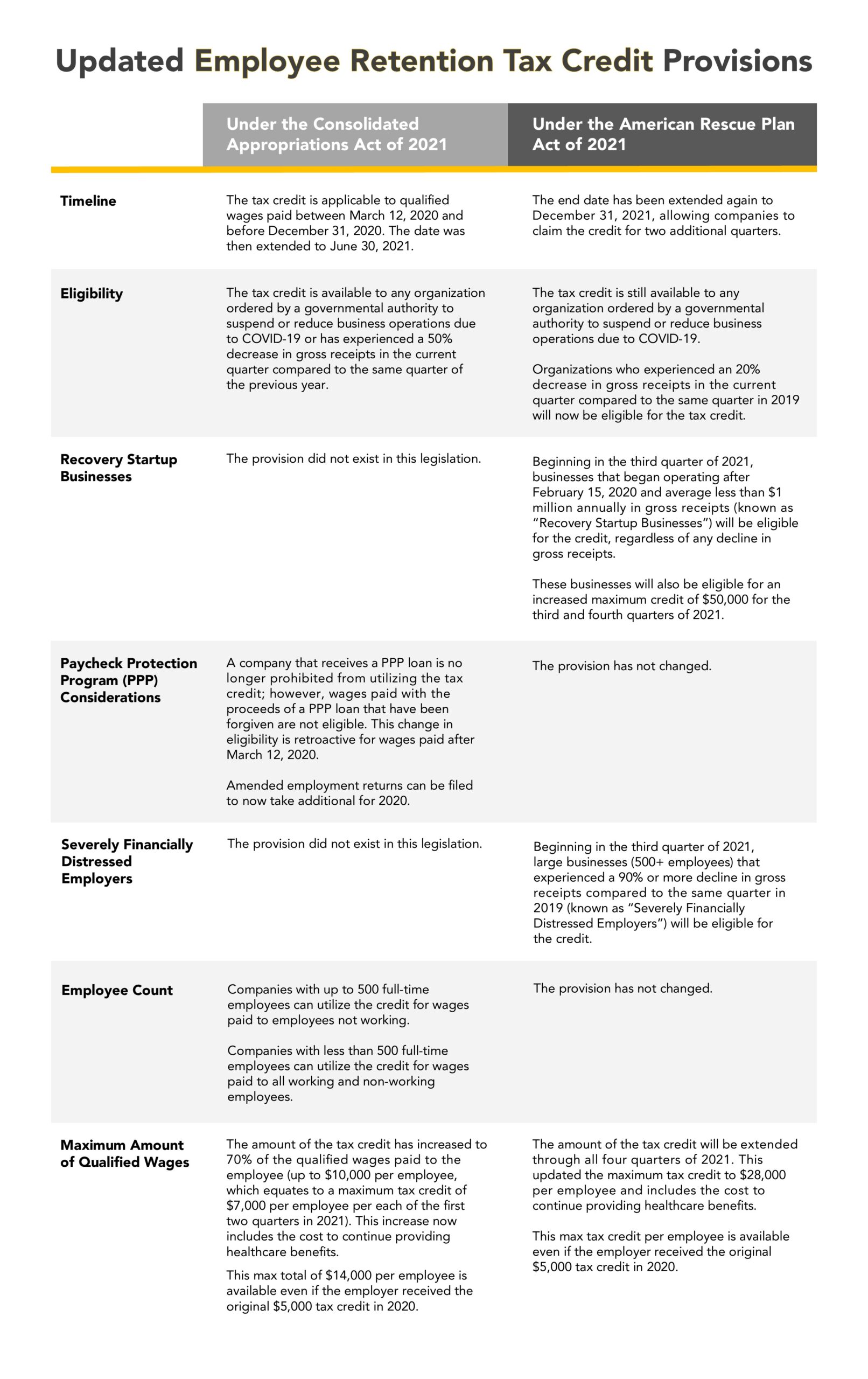

Back in January 2021, we shared with you a breakdown of the changes to the Employee Retention Credit resulting from the Consolidated Appropriations Act of 2021. These updates greatly enhanced the credit, extending the covered wage period, increasing the overall wage ceiling, and more.

Fast-forward to the new American Rescue Plan Act of 2021 (ARPA) signed into law on March 11, 2021, which brought with it another round of updates to the Employee Retention Credit.

Here’s a breakdown of the more important provisions regarding the credit and how those provisions have changed in recent legislation:

Organizations should be working with their external or in-house payroll teams and accountants to code employers correctly and file amended or actual Form 941’s for the credit.

If you qualify for ERC in 2020:

If you qualify for ERC in 2021:

To learn more about how ARPA has effected Small Business Administration loan programs and the Families First Coronavirus Response Act of 2020, please read our article on the SBA/FFCRA updates.

Do not hesitate to contact a member of our tax team with any questions you may have regarding these updates and how they may affect your business. We will update this article as soon as more information becomes available.

To download a copy of the chart, click here.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.