What You Need to Know: IRS Inflation Changes for the 2022 Tax Year

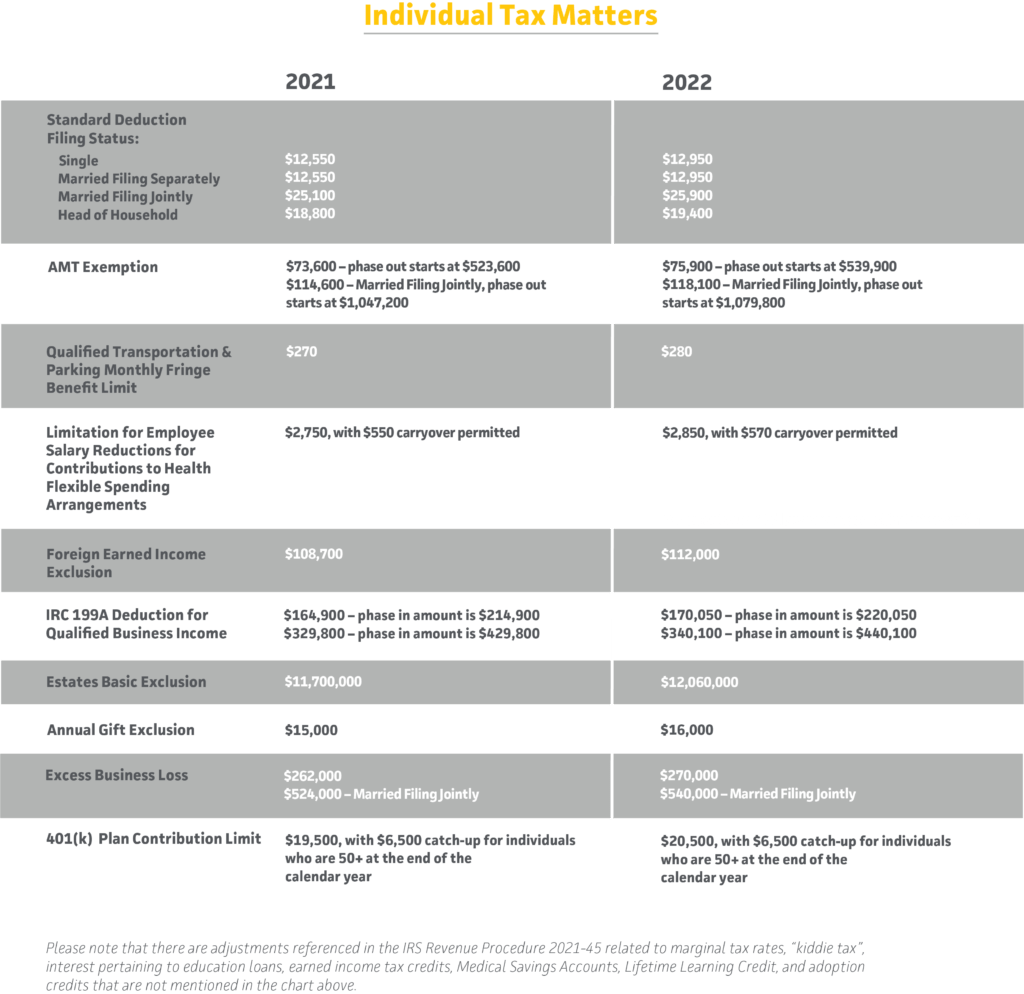

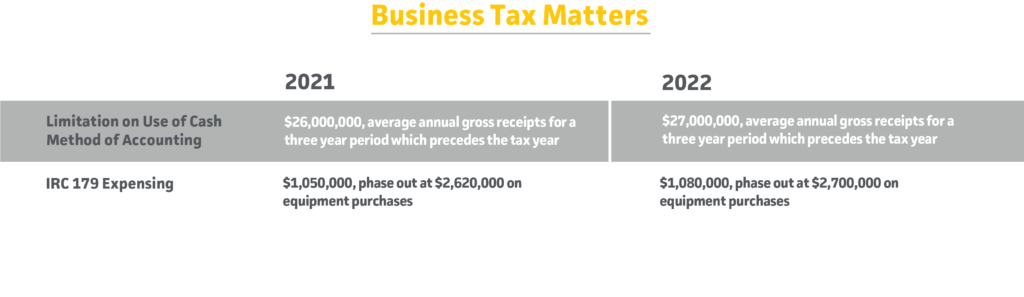

The term “inflation” has been thrown around a lot lately and it may seem like everything that you purchase today costs more than it did yesterday. The IRS has also taken rising inflation into consideration and on November 10th, 2021 released Revenue Procedure 2021-45. This new revenue procedure covers adjustments due to inflation for the 2022 tax year and includes updates to the standard deduction, annual gift exclusion, IRC 179 expensing, and more.

So what’s changed specifically and what do you need to be aware of as the new tax year begins? In the chart below, you’ll find the full list of adjustments, including both individual and business tax matters that could have a major impact:

Reviewing these changes is just the first step to ensuring that you understand how you or your business may be impacted. Contact a qualified tax advisor to discuss the effect of these adjustments in relation to your situation. As always, Ellin & Tucker’s team is here to answer any questions that you may have.

As we approach 80 years, Ellin & Tucker remains firmly in the room, driven by a legacy of excellence in teamwork, leadership, and service. Our strength has always been in our people, and together, we’ll continue to stand with the next generation of difference-makers and leaders, ready to shape the future.